Federal prosecutors blasted Sam Bankman-Fried Wednesday for building a “pyramid of fraud” as he stole $10 billion of his clients’ funds — before claiming on the witness stand to “not remember” details of the alleged scheme.

“He told a story and he lied to you,” prosecutor Nicholas Roos told jurors during closing arguments at Bankman-Fried’s month-long trial in Manhattan federal court, in which the tech golden boy is accused of defrauding his current clients and investors – in exchange for points. FTX bankrupt cryptocurrency.

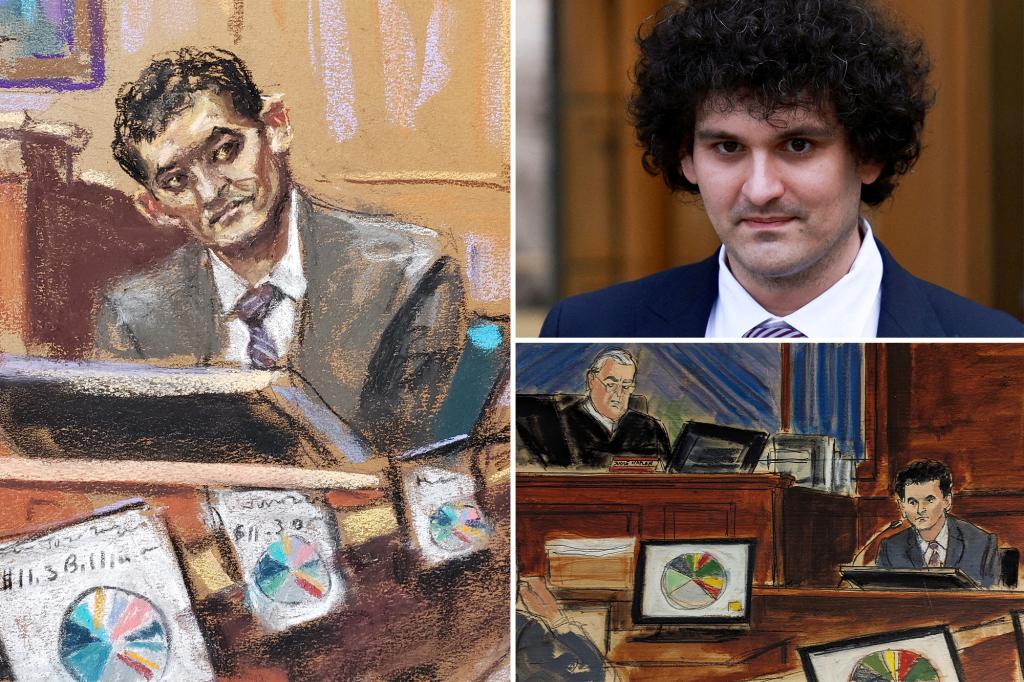

“To believe the defendant’s story, you have to ignore all the evidence,” Roos said during his four-hour closing statement, often punctuating his argument by pointing to the former crypto king, who sat calmly at the defense table in a gray suit and purple tie.

Bankman-Fried, 31, admitted during four days on the stand that his hedge fund affiliate Alameda Research had an unheard-of setup that would allow him to “borrow” a fortune from FTX before both companies collapse in November 2022.

But the MIT graduate insisted that the alleged theft was “permitted” under the exchange’s terms of service — and said he “doesn’t recall” instructing Alameda to have the special ability to siphon off billions from FTX users.

The jury is expected to begin deliberating in the trial of the accused fraudster starting Thursday.REUTERS

“You have to believe that the defendant, from MIT, knew nothing,” Roos told the jury. “You know it’s not true.”

Roos urged jurors to find Bankman-Fried guilty of the seven counts of fraud and conspiracy she faces for allegedly spending clients’ money on items such as a $35 million Bahamas penthouse, as well as repaying about $10 billion owed by Alameda to creditors.

The Bankman-Fried crypto exchange — which at one point was valued at more than $40 billion — was actually a “pyramid of fraud built by the defendants on a foundation of lies and false promises, all to get money,” prosecutors allege.

“That’s cheating,” added Roos. “It’s stealing, plain and simple.”

The prosecutor began his closing statement by presenting the thousands of people who were filled with great anxiety as they futilely removed their “nest eggs” from FTX.

The fallen crypto mogul claimed to “not remember” aspects of his business more than 100 times during his testimony.AP

“Who is responsible? This guy, Samuel Bankman-Fried,” Roos said, pointing to the crypto mogul, who sat calmly at the defense table between his lawyers.

“What happen? He spent his clients’ money and he lied to them about it,” prosecutors alleged.

The disgraced crypto magnate’s claims contradicted trial testimony from four of his former lieutenants — including his ex-girlfriend Caroline Ellison — who told jurors that Bankman-Fried contacted Alameda and ordered top FTX engineers to give company secrets “backdoor access” to FTX client funds.

Meanwhile, Bankman-Fried’s lawyer, Mark Cohen, said that the feds had “unfairly” tried to paint the accused fraudster as “some kind of monster” intent on stealing from his clients – ignoring his work building two “legitimate, legitimate, innovative businesses” before the second – both fell.

Cohen also tried to cast doubt on the testimony of Ellison and other former FTX executives who turned on Bankman-Fried after rejecting a plea deal, claiming that their stories sounded like they played a part in a government “movie” in which Bankman-Fried was cast as a “villain.”

Bankman-Fraud faces life in prison if convicted of all charges.REUTERS

“They got up in the stands and, on cue, said, ‘Sam thinks we should do it,'” Cohen said.

Defense attorneys also claimed that Bankman-Fried’s efforts to repay FTX lenders — for which evidence showed he used client funds — were inconsistent with the prosecution’s characterization of him as a criminal.

“If you’re a fraud, why are you paying back the lender?” she asked out loud. “Why don’t you take the money and run?”

The jury is likely to begin deliberations on Thursday.

If convicted, Bankman-Fried could be sentenced to life in prison.

Categories: Trending

Source: thtrangdai.edu.vn/en/