FTX founder Sam Bankman-Fried’s lawyer on Tuesday said the now-bankrupt cryptocurrency exchange’s investments were not “reckless and frivolous”, dismissing testimony from former executive Nishad Singh that described his spending on marketing and celebrity endorsements as excessive.

Singh, the former FTX engineering chief, testified for the second day in a row at the Bankman-Fried fraud trial in Manhattan federal court. Under cross-examination, Singh told jurors that he thought FTX would have been able to continue in business when it learned in September 2022 about a $13 billion shortfall in customer funds, potentially bolstering Bankman-Fried’s argument that he believed the exchange’s problems were manageable.

FTX declared bankruptcy on Nov. 11. 2022.

Singh testified Monday that the company’s venture investments and $1.1 billion in planned marketing deals, including naming rights to the arena where the NBA’s Miami Heat play and featuring NFL quarterback Tom Brady in ads, “reek of exaggeration and brilliance.”

Defense attorney Mark Cohen on Tuesday asked Singh, one of three former members of Bankman-Fried’s inner circle who has pleaded guilty to fraud and agreed to cooperate with prosecutors, whether promoting the FTX brand could be helpful.

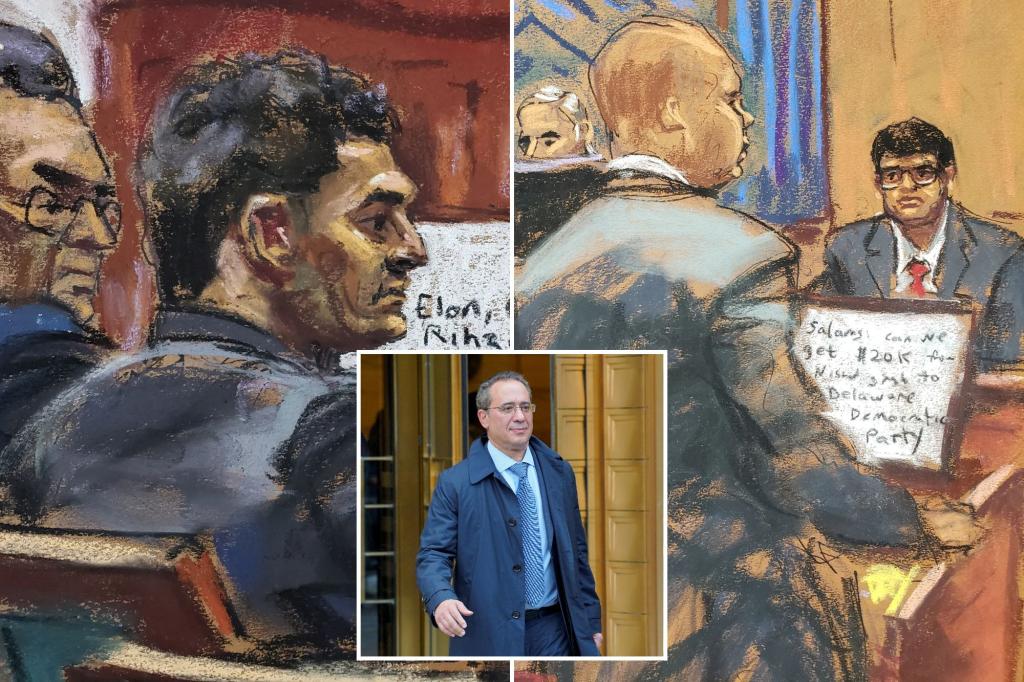

Nishad Singh, senior testified Monday that the company’s venture capital investment and $1.1 billion in planned marketing deals “reeked of excess and glitter.” Defense lawyer Mark Cohen on the left.REUTERS

“I understand it has business benefits and costs,” Singh said in testimony that defense attorneys could use to argue that Bankman-Fried made a business decision she believed was in good faith in releasing funds for marketing and investments even when others disagreed. .

Bankman-Fried is in the third week of his trial on charges involving the looting of billions of dollars in FTX client funds to make investments, donate to US political campaigns and support his hedge fund, Alameda Research. He has pleaded not guilty.

Singh testified Monday that he feared the company’s deal with an investment firm called K5, which Bankman-Fried described as a “one-stop shop” for establishing relationships with celebrities, would prove “toxic” to FTX’s culture.

Sam Bankman-Fried is in the third week of his trial on charges involving the looting of billions of dollars in FTX client funds to make investments.REUTERS

On Tuesday, Singh said K5 also helped Bankman-Fried invest in a tequila brand run by a “famous celebrity,” when asked by Cohen if the firm was more than a relationship broker.

“Yesterday (Monday) we were told these were all reckless and frivolous investments, and I have the right to show that there is more than we were told yesterday,” Cohen said, after a prosecutor objected to his questioning of K5.

In a lawsuit filed against K5 in June seeking to recover $700 million, FTX’s current management said the Bankman-Fried-controlled shell company used $214 million in FTX funds to buy a stake in celebrity Kendall Jenner’s 818 Tequila brand at a time when the company’s tequila assets were valued only $2.94 million. K5 said the lawsuit was without merit.

Bankman-Fried has argued that although he made mistakes running FTX, he never intended to steal funds. His lawyer said he was considering taking the stand as a witness.

The jury has already heard from Gary Wang, FTX’s former chief technology officer, and Caroline Ellison, Alameda’s chief executive officer and Bankman-Fried’s ex-girlfriend.

Cohen questioned Singh on Tuesday about his confrontation with Bankman-Fried in September 2022 after learning Alameda owed billions of dollars to FTX customers. He confronted Bankman-Fried on the balcony of the $35 million Bahamas penthouse they shared with many FTX and Alameda employees.

Singh admitted that he was anxious at the time, and said he was suicidal then and for several months to come. He testified Monday that Bankman-Fried became angry during the conversation.

“Yesterday (Monday) we were told these were all reckless and frivolous investments, and I reserve the right to point out that there is more than we were told yesterday,” Cohen said. REUTERS Bankman-Fried has argued that while he made mistakes running FTX, he never intended to steal funds.AP

After telling Cohen he thought FTX could stay in business “for some time” despite the shortfall, Singh said he had previously told US authorities he thought the company could last for years.

Cohen also pressed Singh about a $3.7 million home he bought using FTX client funds in Washington state in the fall of 2022. Singh admitted buying the Orcas Island home, but said he was “ashamed” and had agreed to forfeit it as part of his plea deal.

“I put myself in front of the customer,” says Singh.

Categories: Trending

Source: thtrangdai.edu.vn/en/