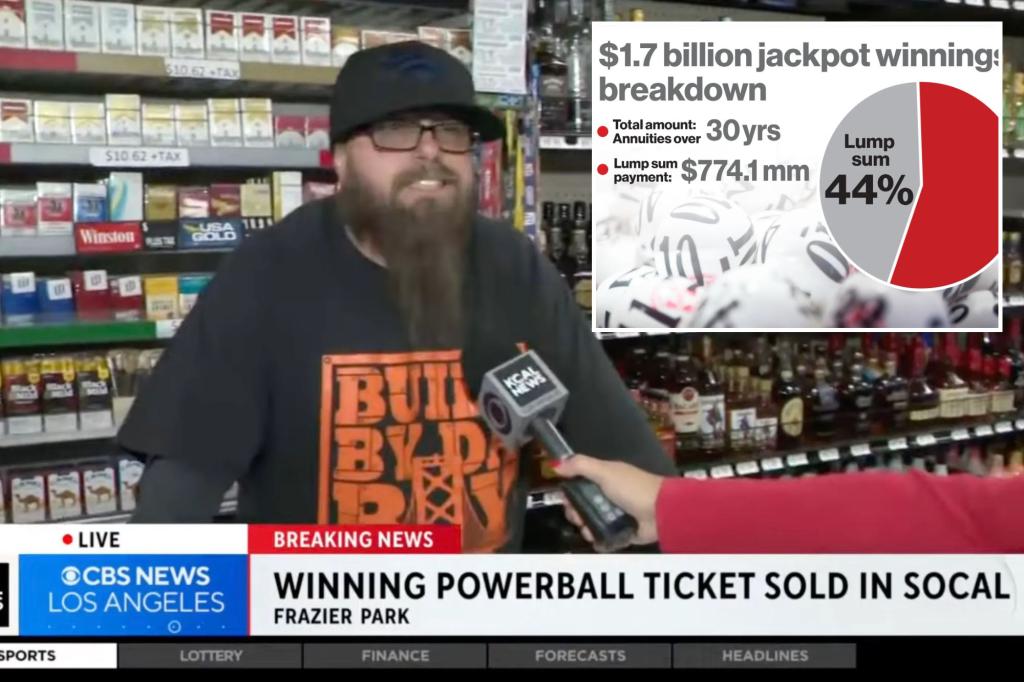

The latest $1.7 billion Powerball winner had the second largest jackpot in history — but could take home just 44% of the advertised amount.

When it comes to cashing in golden tickets, lotto winners can choose to receive their money in one of two ways; immediate lump sum deposit or through 30 annual payments invested in government bonds.

The advertised jackpot is actually the projected amount received over a 30-year investment, while the lump sum is the amount of money Powerball actually has to give away.

In the latest case — won by a person in Kern County, California — Wednesday’s lucky ticket holder will take home a lump sum of around $774.1 million, less than half the advertised jackpot.

The $1.7 billion figure is higher than the lump sum because of currently high interest rates on investments.

The significant difference between the two options represents the lowest lump sum percentage since 2003.

Although experts always advise winners to go for the annuity option because it offers the full jackpot and will serve as a steady stream of income for the next 30 years, it remains unpopular among winners.

A cashier at the California store where Wednesday’s winning ticket was soldKCAL If Wednesday’s jackpot winner chooses to deposit a cash lump sum, they will take home only 44% of the advertised jackpot amount. Powerball

Although the one-time payout averages around 52% of the jackpot, all but five of the 239 big winners since 2003 have chosen that option.

Leon LaBrecque, Sequoia Financial Group’s chief growth officer, told USA Today one of the reasons people skip the annuity option is because they’re likely to die within 30 years.

If the winner dies before all annuity payments come in, they will be subject to estate tax of 40 percent per installment.

“The estate has to pay the inheritance tax, even if the installments have not yet arrived,” he said warmly.

Regardless of the option chosen, it is subject to federal income tax, with the IRS able to take as little as 24% of the winnings.

Chris Khalil, right, helps a customer at the Midway Market & Liquor store where winning lottery tickets are sold in Frazier Park, Calif., Oct. 12.

Fortunately for Wednesday’s winner — whose identity has not yet been released —California does not impose a state tax on lotto winnings, so only the federal government will stake its claim.

However, the person will not remain anonymous because the state requires all winners over $250,000 to reveal their identity.

Wednesday’s Powerball winner bought the ticket at Midway Market & Liquor in Frazier Park, California.

The store’s night cashier, Duke, told local station KCAL: “Someone owes me a truck! A lot of customers come in religiously and say if they win they’ll give me a new truck, so I’m counting on that, I’m waiting.”

In the past year, California has proven it really is the Golden State — especially when it comes to the lottery.

Wednesday’s winners purchased their tickets at Midway Market & Liquors in Frazier Park, Calif. Facebook / Midway Market and Liquors

The biggest jackpot winner of all time Edwin Castro, won the largest Powerball jackpot, $2.04 billion, in November 2022.

However, he didn’t become a millionaire overnight as he opted for a lump sum, which amounted to $997.6 million.

Another $1.08 billion winning ticket, the eighth largest prize in history, was bought in California in July but mysteriously never collected.

Currently, the government is seeing a lot of winnings as billion dollar jackpots have become more and more common, which only makes the lottery more difficult to win.

Lottery expert Victor Matheson, an economics professor at the College of the Holy Cross, said the growing lottery jackpot is attracting more sales. This makes the chances of winning lower but fuels bigger jackpot numbers.

With individuals who actually win an inflated jackpot, lotto players continue to hope they will be next regardless of the odds stacked against them.

“Because the lottery is about selling hope,” Matheson told CNBC.

Categories: Trending

Source: thtrangdai.edu.vn/en/